vermont state tax brackets

More about the Vermont Tax Tables. Vermont also has a 600 percent to 85 percent corporate income tax rate.

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Tax Bracket Tax Rate.

. As you can see your Vermont income is taxed at different rates within the given tax brackets. Vermont has a 600 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 624 percent. Tax Bracket Tax Rate.

4 rows Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax. The Vermont State Tax Tables for 2022 displayed on this page are provided in support of the 2022. 2021 Income Tax Withholding Instructions Tables and Charts.

It ranges from 335 to 875. The Vermont State Tax Tables for 2021 displayed on this page are provided in support of the. Any income over 204000 and 248350 for SingleMarried Filing Jointly would be taxes at the rate of 875.

Tax Year 2021 Personal Income Tax - VT Rate Schedules. Before sharing sensitive information make sure youre on a state government site. Consolidates the number of brackets from six to three and cuts the states top individual tax rate from 7 to 65 for tax year 2022.

We last updated Vermont Tax Rate Schedules in March 2022 from the Vermont Department of Taxes. Vermont has an individual income tax. Like most states with income tax it is calculated on a marginal scale with four 4 tax brackets.

Tuesday January 25 2022 - 1200. 5 rows The Vermont income tax has four tax brackets with a maximum marginal income tax of 875. We will update this page with a new version of the form for 2023 as soon as it is made available by the Vermont government.

Residents of Vermont are also subject to federal income tax rates and must generally file a federal income tax return by April 15 2021. Provides for additional 01 rate reductions each year until the rate reaches 6 starting with tax year 2023 contingent on revenue triggers being met. 4 rows Vermont has four marginal tax brackets ranging from 335 the lowest Vermont tax.

Tax Bracket Marginal Corporate Income Tax Rate. These income tax brackets and rates apply to Vermont taxable income earned January 1 2020 through December 31 2020. W-4VT Employees Withholding Allowance Certificate.

PA-1 Special Power of Attorney. Tax Bracket Tax Rate. The site is secure.

The site is secure. RateSched-2021pdf 3251 KB File Format. Here is a list of current state tax rates.

Tax Rate Filing Status Income Range Taxes Due 335 Single 0 to 40350 335 of Income MFS 0 to 33725 335 of Income MFJ 0 to 67450. State Business Taxes in Vermont The state of Vermont has a Corporate Tax rate with three 3 tax brackets. State government websites often end in gov or mil.

Vermont has four tax brackets for the 2021 tax year which is a. Vermont School District Codes. State government websites often end in gov or mil.

2020 VT Tax Tables. PA-1 Special Power of Attorney. 7500 25 Of the amount over 50000.

2020 VT Rate Schedules. The latest Vermont state income tax brackets table for the Married Filing Separately filing status is shown in the table below. IN-111 Vermont Income Tax Return.

South Carolina S 1087. Vermont collects a state corporate income tax at a maximum marginal tax rate of 8500 spread across three tax brackets. These income tax brackets and rates apply to Vermont taxable income earned January 1 2020 through December 31 2020.

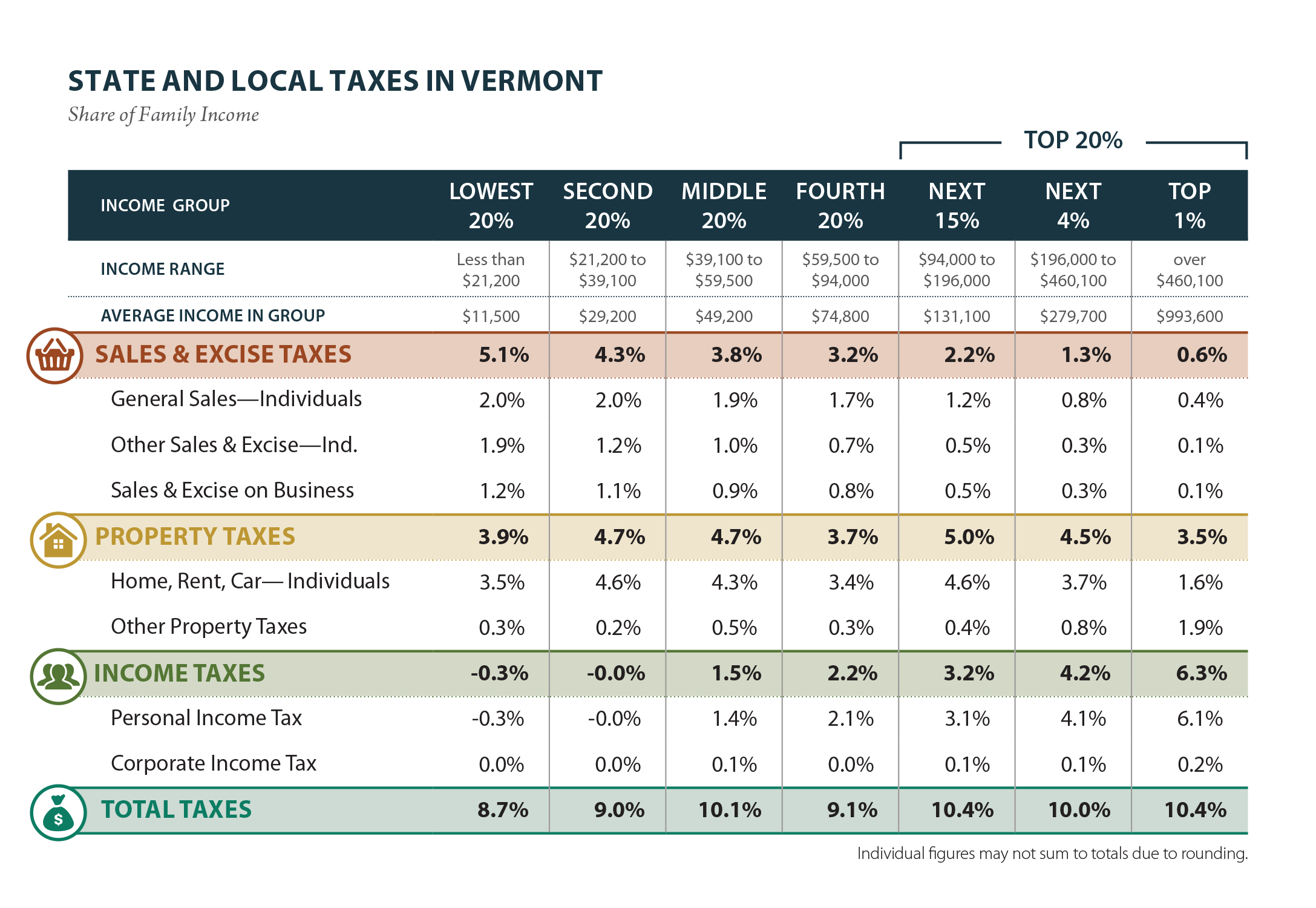

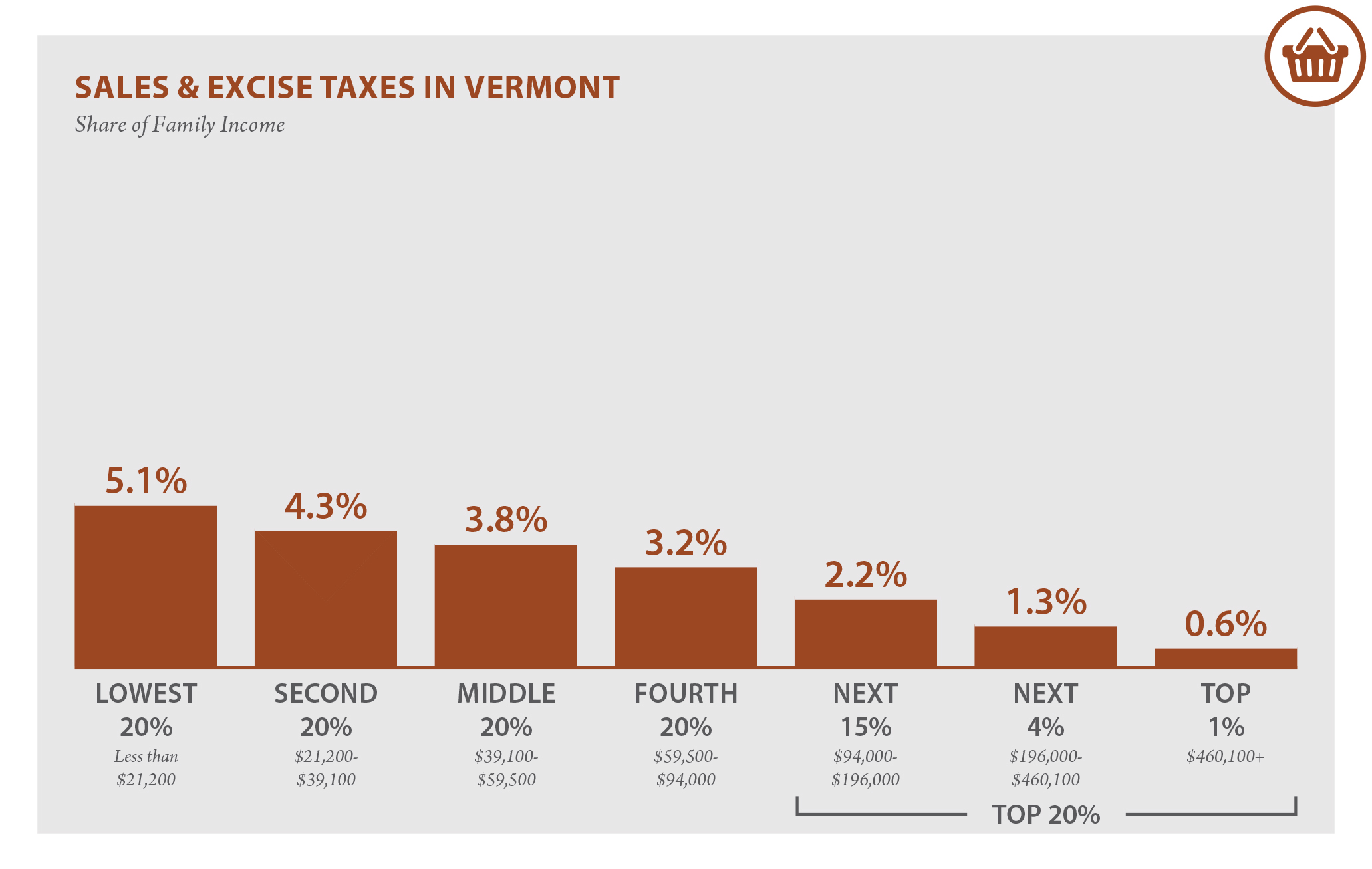

Tax Rates Cigarette Tobacco Tax Rates Education Property Tax Rates Individual Tax Tables and Rate Schedules Local Option Tax Zip Codes Tax Charts 6 Vermont Sales Tax Schedule 9 Vermont Meals Rooms Tax Schedule Alcoholic Beverage Tax Local Option Alcoholic Beverage Tax Local Option Meals and Rooms Tax. Before sharing sensitive information make sure youre on a state government site. 6 State Taxes 024 Average local tax 624 Combined Tax Property Taxes Property taxes are collected by local governments in Vermont and are usually based on the value of the property.

Vermont School District Codes. IN-111 Vermont Income Tax Return. W-4VT Employees Withholding Allowance Certificate.

This form is for income earned in tax year 2021 with tax returns due in April 2022. Read the Vermont income tax tables for Married Filing Jointly filers published inside the Form IN-111 Instructions booklet for more information. The highest bracket of 875 starts for income greater than 200000.

The latest Vermont state income tax brackets table for the Head of Household filing status is shown in the table below. Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. We last updated Vermont Tax Tables in March 2022 from the Vermont Department of Taxes.

This form is for income earned in tax year 2021 with tax returns due in April 2022We will update this page with a new version of the form for 2023 as soon as it is made available by the Vermont government.

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Corporate Income Tax Rate 12th Highest Vermont Business Magazine

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

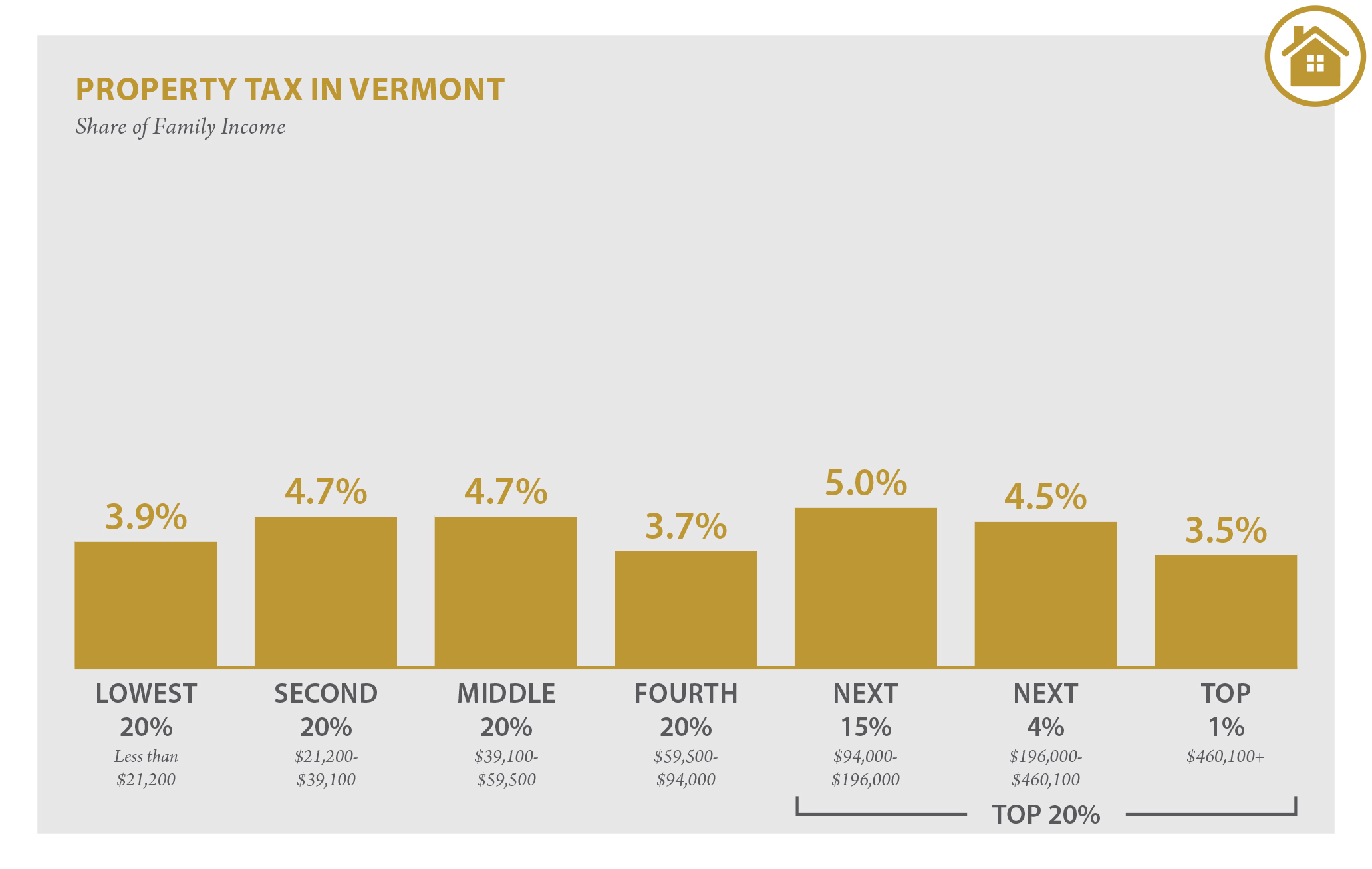

Vermont Property Tax Rates Nancy Jenkins Real Estate

Vermont Sales Tax Small Business Guide Truic

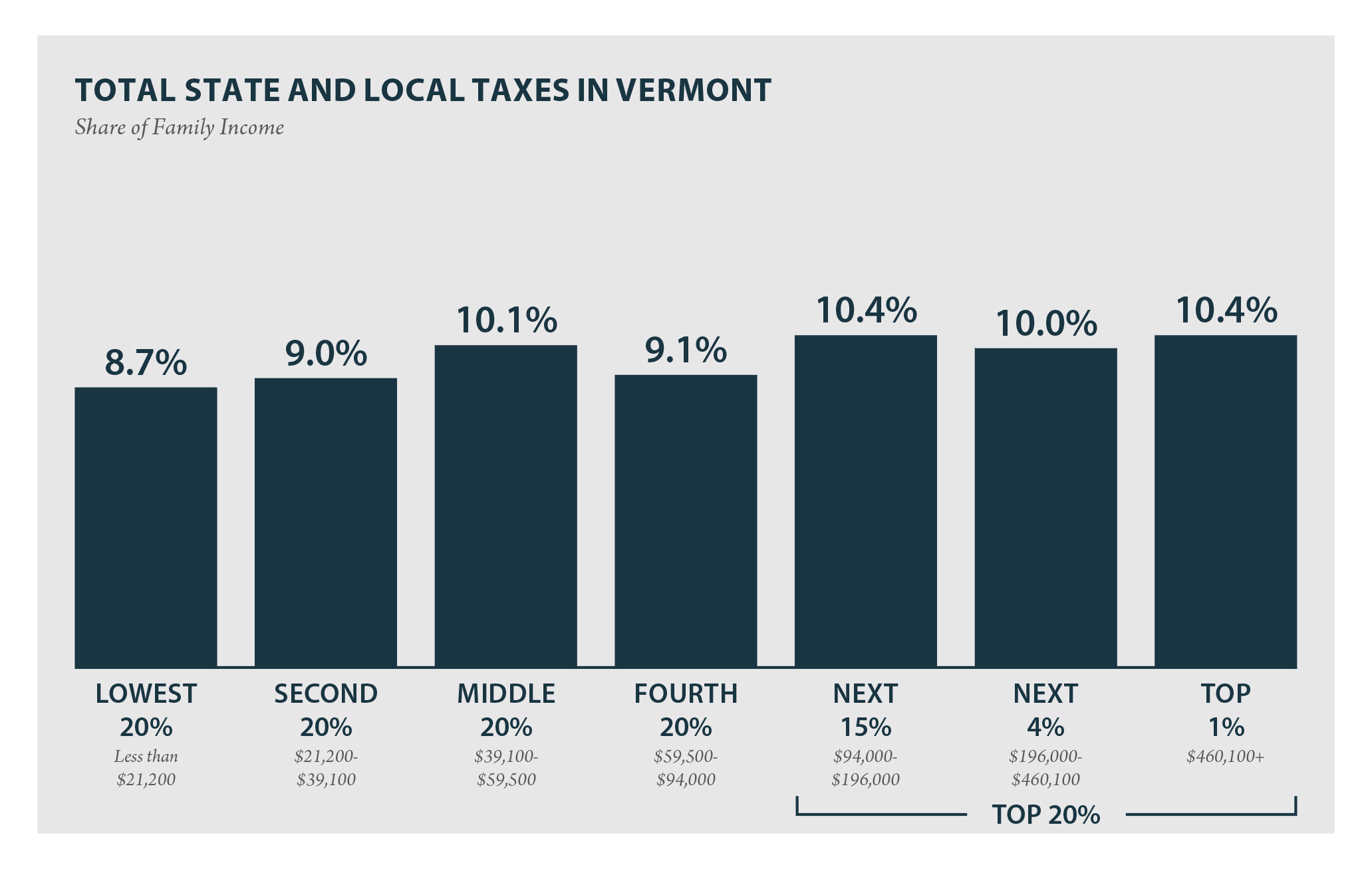

Vermont Who Pays 6th Edition Itep

Vermont State Tax Refund Vt Tax Brackets Taxact Blog

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Effective State Income Tax Map Public Assets Institute

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Income Tax Vt State Tax Calculator Community Tax

File Top Marginal State Income Tax Rate Svg Wikipedia

Vermont Who Pays 6th Edition Itep

The Most And Least Tax Friendly Us States

Vermont Who Pays 6th Edition Itep

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map